As defined on Wikipedia, technical analysis is a security analysis discipline used for forecasting the direction of prices through the study of past market data, primarily price and volume.

This discipline has been enriched by many famous analysts and mathematicians from all over the globe for over a century, and is a vast science in itself.

In this article, I shall be discussing about some fundamental concepts used in the technical analysis of financial instruments.

Technical Analysis – Charts

We all look at a stock’s chart whenever we need to know how it has been performing over a period of time.

A chart that is to be used for technical analysis can be of three types:

- Line chart

- Bar chart, and

- Candle chart

A line chart can also be displayed as an “area” chart, which is nothing but a fill below the line in context. Here are some illustrations of each of the three types of charts.

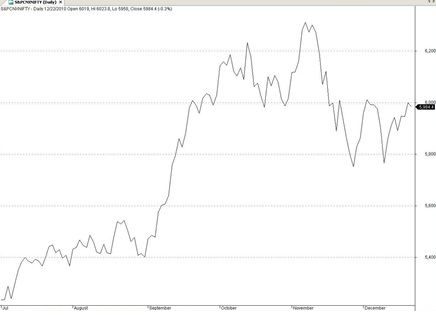

Technical Analysis Basics – Line Chart

Technical Analysis Basics – Bar Chart

Technical Analysis Basics – Candlestick Chart

A bar chart and a candlestick chart provides much more detail about price action as compared to a line chart. Each bar depicts the open, high, low and closing price for the given time interval.

Charts can again be classified as per the time frames they represent, viz 1 minute, 5 minute, hourly, daily, weekly and so on.

Let us now move on to discuss the basics of a few popular indicators.

Technical Analysis Indicator – MACD (Moving Average Convergence Divergence)

Technical Analysis Indicator – MACD – Moving Average Convergence Divergence

Invented by Gerald Appel in the 1970s, the MACD primarily measures the difference between a fast moving average and a slow moving average.

While a fast moving average reacts more quickly to recent changes in price than its slower counterpart, the difference between them keeps widening or shortening from time to time.

When the difference widens, the MACD reading goes higher and indicates stronger trend. The reverse happens when the difference between the two moving averages reduces and the MACD value falls – which indicates weakening of trend strength.

Typically, a 26 period and a 12 period exponential moving average constitutes the slow and fast moving averages of the MACD respectively. Along with these, a 9 period moving average of the MACD itself is used to detect possibilities of trend reversal.

Technical Analysis Indicator – RSI (Relative Strength Index)

Technical Analysis Indicator – RSI – Relative Strength Index

The RSI is another popular indicator that measures the intrinsic strength of a stock.

Its value ranges from 0 to 100, of which a higher value obviously denotes a higher strength of a trend.

A very popular method of using is the RSI is to use two filters – one at 70 and the other at 30 – wherein a value below 30 denotes an oversold condition while anything above 70 indicates overbought condition.

The indicator was first introduced by Welled Wilder in June 1978.

Technical Analysis Indicator – CCI (Commodity Channel Index)

Technical Analysis Indicator – CCI – Commodity Channel Index

Developed by Donald Lambert, the CCI measures variation of a security’s price from its statistical mean.

In this case, a popular interpretation is that a value above 100 indicats an overbought condition while that below -100 denotes an oversold condition.

This indicator is very popular among analysts, and is widely used in the industry for detection of changes in trend.

Another method of using the CCI is to look for divergences in the trend of the CCI and that of the stock. Whenever any such divergence is observed, it can be considered that a change of trend is imminent.

This article has been written by Somnath Mukherjee, who is the founder of MoneyPlanters, a technical analysis blog about accurate prediction of stocks based on the secret strategies of W D Gann.

He is passionate about the financial markets and Indian Classical Music. Connect with him on Facebook and Google+